In spite of plummeting oil prices, UPS just changed the tables used to calculate fuel surcharges, resulting in yet another rate increase for shippers. New, higher fuel surcharges for UPS Air, International and Ground products will change effective Feb. 2.

You didn't miss the UPS memo. The corporate email didn't go into your junk folder. Your UPS sales rep didn't forget to call. There was no announcement. UPS simply updated the tables and posted them to its website overnight.

Can it do that?

Well, it just did. When you ship with UPS, you're agreeing to all the terms and conditions in its service guide at the time of shipping, which is subject to change anytime without notice.

Even customers under term contract agreements are impacted. In fact, 99.9 percent of shippers don't have specific fuel surcharge tables written into their contracts.

Why would UPS do this? Are fuel costs coming down? Didn't UPS just implement a huge rate increase on Dec. 29, 2014, with some service/weight/zone configurations increasing 5 percent to 10 percent? Did it not also just change to dimensional pricing for all Ground products, resulting in average increases of 17 percent as reported in The Wall Street Journal?

The answers to these questions are yes, yes and yes.

In my mind, the latest UPS action is a pure money grab. It's raising fuel surcharges because it can. And most of us will pay it. In fact, most shippers will never be aware they're paying more!

How much more? Table one below reflects modeled examples of the increase for UPS Air and International products.

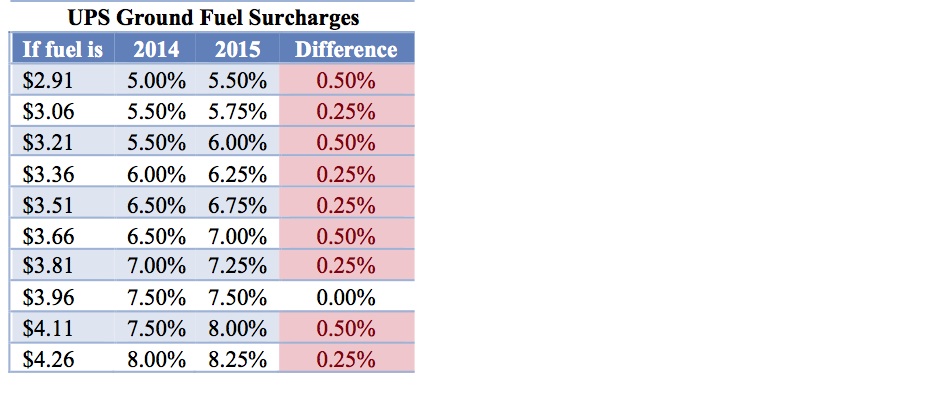

Table two reflects modeled examples of the increase for UPS Ground products.

The topic of my last Shipping Insights column was that FedEx announced that it would revise its fuel surcharge tables effective Feb 2, 2015. At least FedEx had the courtesy to announce the change and give shippers 30 days notice.

Because UPS fuel surcharges have been higher than FedEx's since November 2012, while still a money grab, it was somewhat justifiable for FedEx to bring its fuel surcharges in line with its primary competitor. However, just as soon as FedEx made its announcement, UPS saw an opportunity to hike up its own fuel surcharges as well.

Having been in the parcel business for the past 25 years, UPS's latest action tells me that the company feels that having slightly higher fuel surcharges than FedEx has not been a competitive disadvantage over the past two years. Frankly, the reward outweighs the risk. After all, half a point on $40 billion (estimated 2014 U.S. domestic and international package revenue) is $200 million incremental revenue with zero added operational costs.

With this latest tinkering of the fuel surcharge tables, how do the carriers compare? FedEx continues to maintain an advantage over UPS (see Table 3 below).

Shippers should also be aware that UPS applies fuel surcharges — in addition to package cost — to several surcharges as follows:

- Ground fuel surcharges also apply to pickup charges, return services charges, international extended area charges, delivery area charges, residential surcharges and large package surcharges.

- The Air and International fuel surcharge also applies to pickup charges, return services charges, UPS Next Day Air Early A.M./UPS Express Plus Charges, international extended area charges, delivery charges, residential delivery charges, Saturday delivery and pickup, large package surcharge, and oversize pallet handling surcharge.

The new UPS fuel surcharge tables are available for viewing here.

- Categories:

- Shipping

Rob Martinez is the CEO of Shipware LLC, a professional services firm that transforms businesses through intelligent distribution solutions and strategies. Rob has helped some of the world’s most recognizable brands reduce parcel shipping costs an average of 25 percent through contract negotiations, rate benchmarking, modal optimization, invoice audit and other savings vehicles. A cum laude graduate of UCLA, Rob has 20 years of transportation industry experience, including executive positions at DHL and Stamps.com, in addition to his work as an outside consultant since 2001.